Not known Incorrect Statements About Estate Lawyers Brisbane

Wiki Article

Things about Qld Estate Lawyers

Table of ContentsWhat Does Will Lawyers Brisbane Mean?Not known Facts About Qld Estate LawyersThe 15-Second Trick For Qld Estate Lawyers7 Easy Facts About Will Lawyers Brisbane DescribedUnknown Facts About Estate Lawyers BrisbaneNot known Facts About Probate Lawyers Brisbane

Considering that tax regulations as well as regulations transform every now and then, wills as well as estate strategies should be examined periodically. Tax obligations and other expenses should be thought about in identifying the most effective approach of owning and throwing away property. It is our belief, however, that personal purposes as well as needs must be considered in advance of tax ramifications in selecting options.to partner or dependant kid(ren) under Will for surrender benefit?.

His details is included at the base of this post. When doing estate preparation, commonly there is no one "best method" vs.

Rather, instead can be trade-offs with the decisions that choices made both in drafting documents composing papers reviewing or assessing changes to adjustments titling property beneficiary as well asRecipient There is no "one size fits all" covering method because each person or couple may really feel certain planning purposes are a lot more essential to them than various other objectives in their specific circumstance.

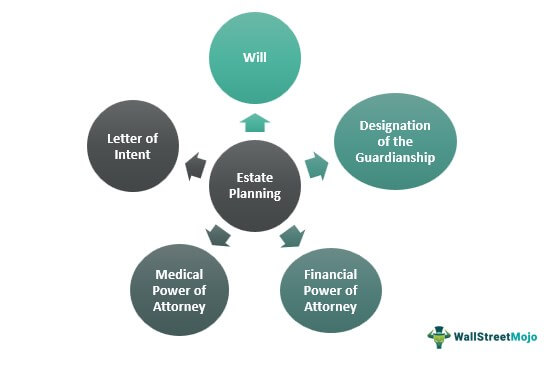

To aid mount any conversation or review of estate preparation it is useful to keep in mind some of the much more usual, basic estate planning objectives that we all have. In no certain order, apart from possibly how typically we typically hear them, these usual estate planning purposes commonly consist of the following: To achieve this unbiased substantially all properties must be either owned by trust funds, had with automated survivorship legal rights with another individual, or payable at fatality to family or desired beneficiaries through a recipient classification.

Qld Estate Lawyers Fundamentals Explained

Typically talking, if inheritance tax at some degree might be a concern for the customer or another person who would certainly obtain properties (e. g. a spouse, kid, or various other beneficiary), after that to prevent or reduce estate tax obligations, the client typically wants most or all of t beneficiary assets to be owned by several trusts prior to death, or to pass right into the client's count on(s) automatically at death.

Depending on the worths of the customer's possessions, their partner's properties, and/or their children's/ recipients' assets, if reference the customer does not have actually assets possessed by a trust fund it might create some possessions to be eventually based on government or state degree inheritance tax at some later time. Many people anticipate the day when the home loan on their home is settled.

Some Known Factual Statements About Qld Estate Lawyers

For this purpose, assume of a financial institution in basic non-legal terms as anyone whom you would not want to obtain your money or possessions. QLD Estate Lawyers. When a customer leaves possessions, retirement plans as well as life insurance policy to a surviving partner, kids, grandchildren or others for an inheritance, they can leave it to them in a method that is versatile for them to access, yet possession shielded.

, particularly in the following situations: (1) the making it through spouse remarries as well as then dies or separations, and (2) a youngster or grandchild marries and afterwards passes away or separations. Will the estate preparing papers be innovative and extensive adequate to expect the unforeseen, for those scenarios and perhaps others? If assets are possessed by a trust it aids make certain that possessions will certainly remain within the family as intended regardless of how life or else plays out in the future due to the fact that a trust arrangement should proceed to manage and also take care of things Your Domain Name as designated as well as usually has thorough arrangements for future usage and distribution of assets (will dispute lawyers brisbane).

Indicators on Qld Estate Lawyers You Need To Know

The minute a straight-out/ basic present is made to a person, whether throughout life or at fatality, control over that gift is quit. Throughout the client's life time if they have a revocable count on, it does not need a different tax obligation ID number. The client merely utilizes their social safety and security number.At such time, the revocable count on (as well as all other trust funds that stream from that document) will certainly have a different set of effective federal and also state tax obligation brackets, ranging from 0% on up to the highest marginal tax rate then effectively. Occasionally a depend on can preserve taxed earnings in a reduced mixed federal and state brace than a partner, youngster, or various other recipient would go through if they received it.

For instance, tax obligation regulations relating to retirement and IRA accounts may include complexities when a count on is a recipient of such retirement or accounts. Trust funds typically have stipulations that allow a trustee to terminate a trust if the possession worths are below a particular buck threshold (e. g.

The Facts About Probate Lawyers Brisbane Revealed

Along with these typical objectives provided above, your customer may have other added estate preparation goals. With thoughtful reflection as well as discussion, all of their estate preparing purposes ought to be discussed in "ordinary English". Once they can verbalize their estate planning objectives in plain English, it's time to collaborate with a certified estate preparation attorney and various other experts to: (1) draft as well as customize an estate strategy, and (2) retitle/line up properties properly to collaborate with the estate strategy.

Jeff later earned his legislation level and his masters of legislations (LLM) in taxation, with honors, from IIT Chicago-Kent College of Law. Jeff has actually returned to the occupation as well as area in numerous methods. Jeff was a you could try this out complement professor at De, Paul College University of Legislation educating a sophisticated estate and tax obligation planning course.

Report this wiki page